The Foundation Bottom Feeders

Foundation Capitalism Part 3: The Ecosystem of Opportunism

James Carville once said “Drag a $100 bill through a trailer camp and there's no telling what you will find”. Imagine running through that trailer camp with a billion dollars in a bucket.

But giving money away is more complicated than walking down the street with a bucket full of C-notes. There is an entire process of grant-making demanding time, people and strong management to strategize, implement and follow up. Most billionaires don’t have time to spend on due diligence, donor relations, executive board management and ex-post assessments. Fortunately there is an entire professional class of consultants and well-connected philanthropic experts who can come in and take over the process.

And in the process, rewrite that process. As the opportunists take over, they are changing the role philanthropy plays in western societies.

Part 3 of this Foundation Capitalism series looks at the ecosystem of consultants, advisers, lawyers, marketers, fund analysts and project managers who have found enormous opportunity in the giving process. With many foundations showing a benign neglect of the philanthropic process, they have left their wealth vulnerable for exploitation by cunning, well-connected political actors who, via their networks and political interests, are changing the face of philanthropy.

Foundation management consultants

It does not take long for an entrepreneur to look at the administrative overhead in setting up and running a foundation and conclude it is not an activity worthy of time and effort. In 2017, when people were wondering why Amazon founder, Jeff Bezos, was not giving away his billions, he replied honestly, that he did not see much value in the present grant-giving process and invited people to help him innovate (disrupt) philanthropy.

In most cases with tech billionaire funds, the foundations have been largely outsourced to consultancy firms who can take over the management, research, board management, donor-relations, investment, PR and communications functions. All the billionaire has to do is show up at public events and accept the accolades. It may not be what Jeff Bezos had in mind, but it shuts up the critics.

One good example is Pacific Foundation Services – a one-stop shop to take the billions off of your hands. They provide philanthropists with strategy, administration and grant-making services. In covering all services, one can imagine how easy it can be for an army of politically motivated consultants to move in and refocus the grants and board members to groups that fit their own ideological interests.

Of course these foundation consultants are discrete so we really don’t know how many of them are influencing the philanthropic world and to what extent. I came across Pacific Foundation Services when I found some rather inconsistent giving from the Skyline Foundation (formerly the Yellow Chair Foundation) in funding a rather ethically-challenged Environmental Working Group (EWG) campaign. The Skyline Foundation was established by tech billionaire and Yahoo! co-founder, David Filo, with his wife Angela, but it is passively managed by a small staff. When their website stated they were managed by Pacific Foundation Services, the puzzle started to come together.

Skyline on its own could not, and would have no reason to operate a donor-advised fund, where third parties would donate anonymously to the foundation with the money expressly earmarked for a particular campaign (like the EWG working with a tort law firm to create a report that could be used for a class action suit). I’m sure the Filos are unaware of how their foundation has become a political tool weaponized to generate public fear and outrage, using dark funds from other interest groups to achieve their objectives.

The process becomes even more opportune when the philanthropist passes away and the heirs are too busy or too divided to bother following up. The consultants managing the fund, the board and the operations can do what they want. This type of opportune activism is most prevalent in campaigns against industry and capitalism on public fears on climate, plastics, e-cigarettes, pesticides, chemicals, processed foods and biotechnology.

Bundling Foundations

It gets more curious when these foundation consultants, managing multiple funds, can find the means for efficiencies and scale up campaigns by combining or bundling foundations together into larger projects. So a group like Pacific Foundation Services would create a campaign and bring in multiple foundations to provide the funding. This venture capital model in the philanthropic world is just one more example of how “foundation capitalism” is creating an economic and financial impact on Western societies. Activists, for example, have a project that requires financing, they then conveniently tap into the different foundations they are managing and execute on a larger scale. The consultant becomes, to a certain extent, an activist NGO, just with unlimited funding, very little scrutiny, no need for transparency, and it is all tax deductible.

Skyline Foundation is aware that Pacific Consulting Services are bundling their grants into larger projects they are managing and find it an efficient deployment of capital.

This bundling of foundations into campaign-driven coalitions is a market evolution that follows quite naturally from the outsourcing of philanthropy to the activist campaigners cum consultants. The administrative cost efficiencies have led to political activism efficiencies.

Foundation Proxies

The next logical step in this scaling of campaigns is for a group of foundations to create an entirely new foundation for the purpose of a (perhaps controversial) campaign. This would be the equivalent of a SPAC in the investment world with the consultants appointing an activist from their network to implement the campaign via a third-party “special purpose” trust.

A recent case was covered in the Firebreak analysis of Sher Edling, the law firm for climate activists who have no intention of ever seeing a case actually brought before a jury. Sher Edling are paid by foundations to sue fossil fuel companies on behalf of state and local governments for compensation for damages allegedly brought about by climate change. The chances of ever getting a court hearing for these cases are next to zero, but the purpose is to simply continue to be a nuisance to these companies while generating negative publicity.

This is rather controversial as it does not represent a positive or productive use of foundation funds, so foundations with climate objectives band together behind other funds. Initial funding for the Sher Edling strategy came from the Resources Legacy Fund (itself started as a special interest campaign foundation by the Packard Foundation) but the seed money (several million in 2017) came from the Rockefeller Brothers and Rockefeller Philanthrophy Advisers (another back-office philanthropic service organization).

The Sher Edling “project” then took another twist with a different type of entity entering the campaign. The New Venture Fund took over the funding responsibilities from the Resources Legacy Fund. This organization identifies itself as foundation builders or, rather, as “fiscal sponsors” of projects. With access to a network of activists running foundations with billions at hand, groups like the New Venture Fund are today’s venture capitalists. In the spirit of this Foundation Capitalism series, they even refer to their leaders as “non-profit entrepreneurs”.

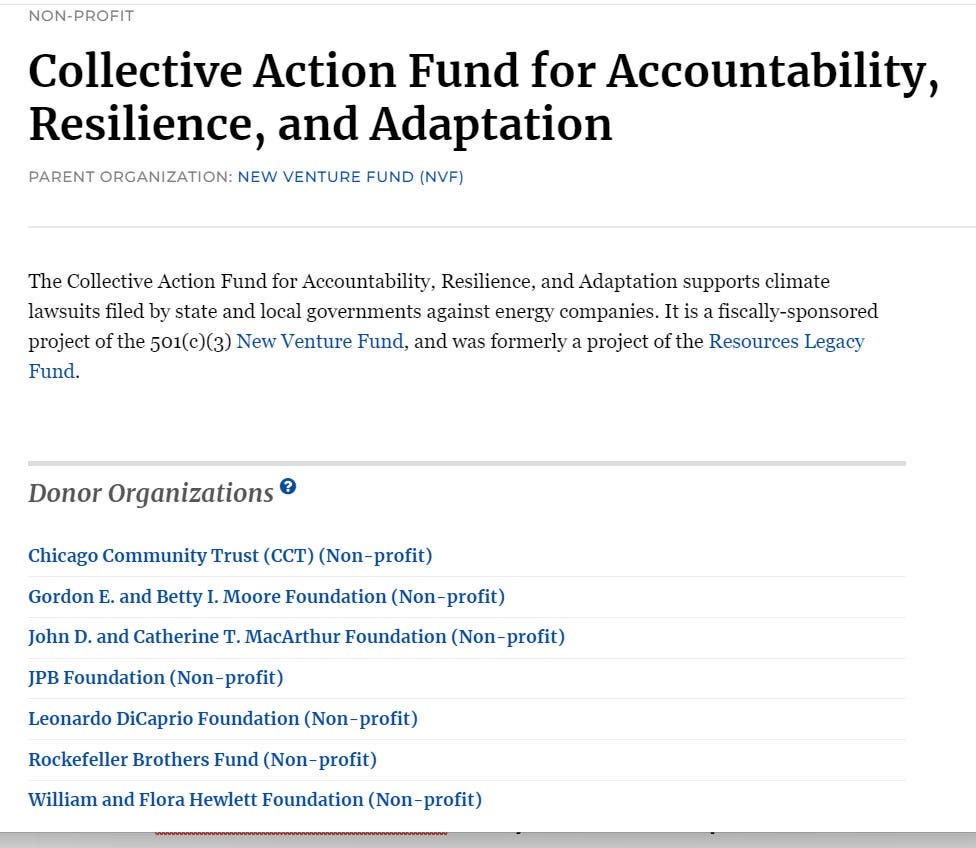

On the Sher Edling fossil fuel lawsuit campaign, the New Venture Fund created the Collective Action Fund for Accountability, Resilience, and Adaptation (CAF). This “organization” has no website nor public representation, staff or history; it is a foundation only in name, brought about to finance the rather controversial Sher Edling campaign paying tens of millions to a specially created law firm to harass fossil fuel companies (on behalf of large foundations acting quietly behind the scenes).

The New Venture Fund brought in seven large foundations under a foundation they created to fund a specially-created law firm to pester fossil fuel companies. The Firebreak article on Sher Edling concluded these fiscal sponsors had discretely paid the law firm in excess of $10 million to just be a nuisance. Sweet.

For those who like being annoyed, Sher Edling also secretly pays consulting fees to Naomi Oreskes, a friend to all of the foundations supporting the fiscal sponsor and architect of the entire bogus lawsuit campaign strategy.

Looking at the cases they take on, they should be called the New Vulture Fund. Sorry if that comes across as rude, but these political activist groups are in no way foundations in the philanthropic sense of the word.

Foundation Hedge Funds

Speaking of vultures, the most sinister evolution of foundations via the back-office is, no doubt, the bouquet of institutions brought together by the concept of “Effective Altruism”, known as Effective Ventures (EV). A recent Firebreak article showed how EV is a cult, with several of the nine different EV foundations aimed at attracting young people into philanthropic (re: meaningful) careers where they are promised they can make a difference. More of a social movement, EV foundations provide funding for their young followers to engage, network and travel (with Time Magazine recently exposing multiple cases of sexual abuse of young EV followers led to Silicon Valley under the EV programmes). How is this possible?

Effective Ventures is a group of organizations funded by third parties (donor-advised funds) so they can use the billions they receive from wealthy individuals, mostly raised by deftly targeting the tech and crypto donors, to develop their own networks and create an army of young, passionate future philanthropists. Sam Bankman-Fried was perhaps the best known protégé of the Will MacAskill School of Utilitarianism, so passionate about “earning to give” that the one-time crypto king gave away other people’s money (around $8 billion has simply gone missing, a lot through EV funds).

Effective Ventures is set up like a hedge fund, with different fund managers running a collection of concentrated “donation desks” to give away funds in what they claim is the most cost-efficient and effective manner. But as many are finding out, this fund management structure leaves a lot of power and influence on a few individuals with little scrutiny or accountability. A very active Reddit group has been examining how EV fund managers were giving away ridiculous amounts to causes that were more in their own interests (like grants to former roommates, friends and family) than to better the interests of humanity.

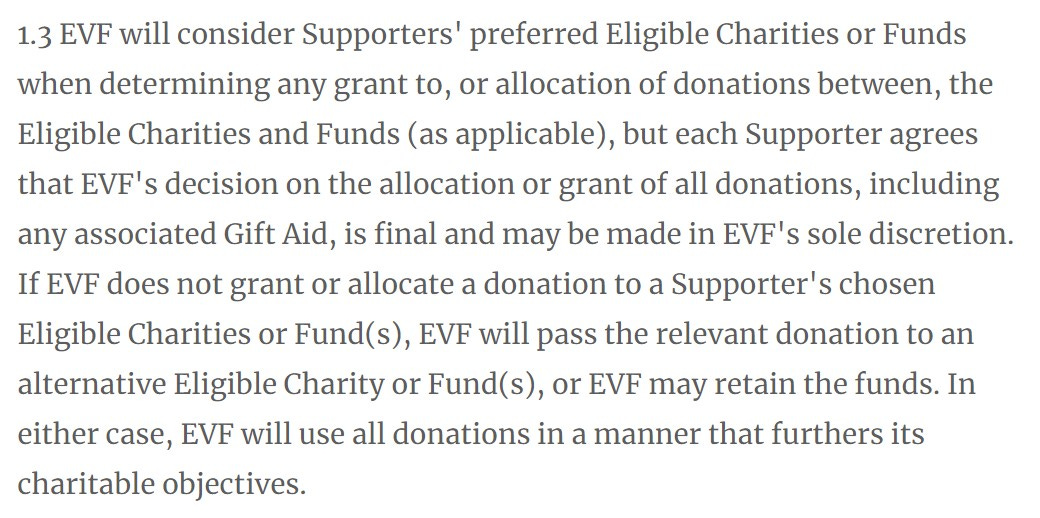

We have to consider Effective Ventures as a capitalist holding entity, designed to maximize revenue to strategically grow the business. And in the fine print, they actually say so. Any donation to the organization, while it can come with recommendations, will be managed according to the discretion of the fund manager to decide upon, without recourse from or discourse with the donor. Thanks for the dosh, now let the Big Boys take over.

Many donor-advised funds charge a commission to justify the processing of the funds while protecting the anonymity of the interest groups. Effective Ventures claims they do not charge commissions, but then admit they will take whatever they need to develop their organization.

The problem with cults is that after drinking too long from the Kool-Aid jug, they actually believe that such actions are perfectly acceptable given all of the wonderful things they are told they are doing.

What Effective Ventures demonstrates is that the outsourced foundation management approach has evolved to the point that the consultants, opportunists and bottom-feeders have now turned to creating their own foundations, putting strategic and ideological objectives in place before any wealth is acquired. It is brutal, naked capitalism where greed and opportunism run rife with little scrutiny or accountability.

The bottom-feeders are now feeding from the top.